With the many different activities and bookings Schools Plus host, the VAT rules vary for each. They can be complex but our teams are here to help you navigate the rules and further understand where your booking, event, or activity fits into them.

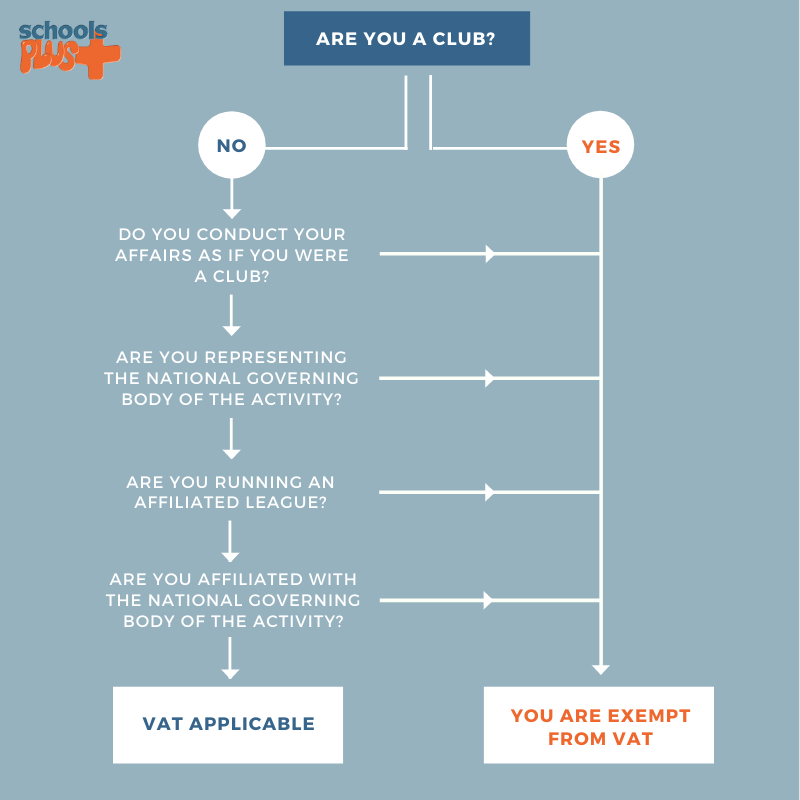

When making a booking we automatically apply VAT. However, you may be wondering if you qualify to be VAT exempt. The below flow chart will tell you if you fit the criteria.

If you’ve worked your way through the chart and have landed on the right boxes, there are yet further regulations that need to be met before you can fully qualify.

Your booking must also adhere to the following criteria:

- You must book a minimum of 10 sessions

- The booking must be for the same sport using the same facility

- The facility must be a sports facility i.e. sports hall, 3G pitch (must-have sports lines printed)

- Each booking must be at least 24 hours apart but no more than 14 days apart

- You cannot cancel any of these first 10 sessions and still receive the exemption

- The first 10 bookings must be paid in full before the bookings take place

All these and more can be found on the web link below:

https://www.gov.uk/guidance/vat-on-land-and-property-notice-742#sect5

Some bookings are automatically required to charge VAT.

These include:

- Hire of any school technology and/ or labour

- Deposits that are nonrefundable

- Hiring out a car parking space on its own without also booking a facility

- VAT to be charged on any storage used if you are also paying VAT on your booking

- If food and drink are part of the booking (not including soft drinks/ biscuits)

If you have any further questions regarding this subject, please don’t hesitate to get in touch on any of the below contact details.